Equity Loan Options: Selecting the Right One for You

Equity Loan Options: Selecting the Right One for You

Blog Article

Debunking the Certification Process for an Equity Loan Authorization

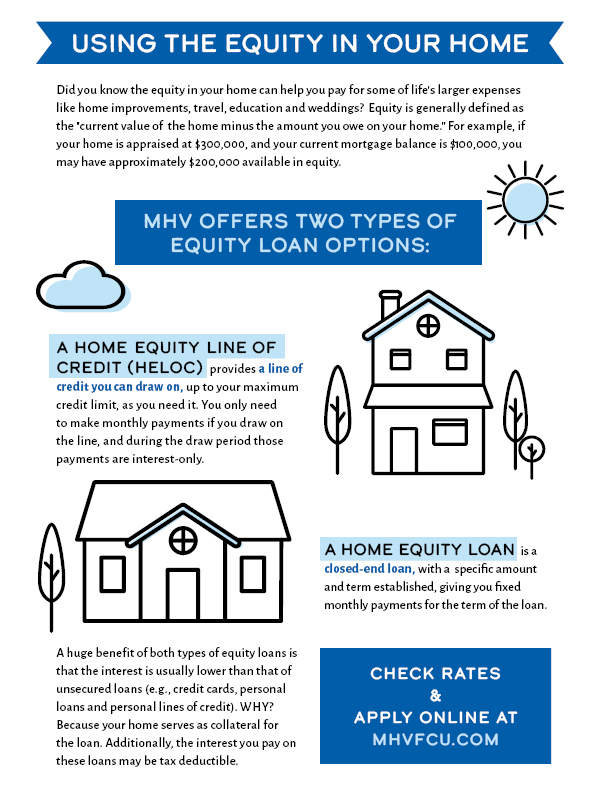

Navigating the certification procedure for an equity financing approval can commonly seem like decoding a complex puzzle, with various aspects at play that identify one's eligibility. Understanding the interaction in between debt-to-income ratios, loan-to-value ratios, and various other key requirements is paramount in securing authorization for an equity finance.

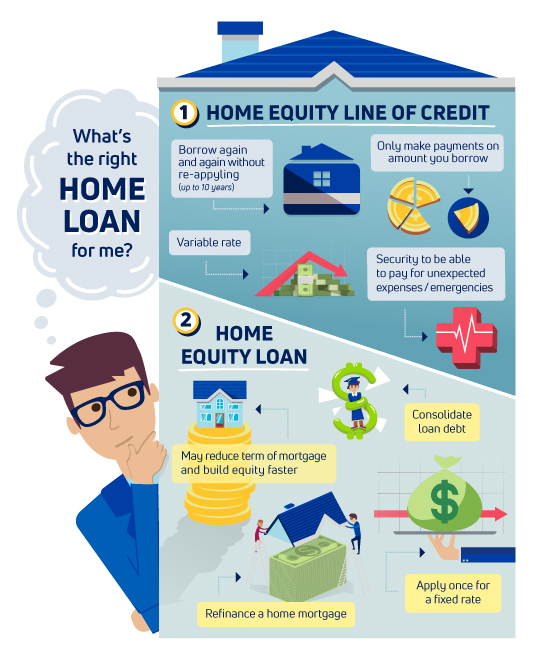

Key Eligibility Standard

To certify for an equity loan authorization, conference details vital qualification criteria is crucial. In addition, lending institutions assess the candidate's debt-to-income proportion, with the majority of favoring a proportion below 43%.

In addition, loan providers evaluate the loan-to-value ratio, which compares the quantity of the financing to the evaluated value of the home. Meeting these crucial qualification requirements increases the probability of securing approval for an equity financing.

Credit Rating Importance

Lenders often have minimum credit rating score demands for equity car loans, with ratings over 700 usually thought about excellent. By maintaining an excellent credit report rating through prompt bill payments, reduced debt utilization, and liable loaning, applicants can improve their possibilities of equity funding approval at competitive rates.

Debt-to-Income Ratio Evaluation

Offered the crucial duty of debt scores in establishing equity funding approval, one more important element that lending institutions analyze is a candidate's debt-to-income proportion evaluation. The debt-to-income proportion is an essential monetary metric that offers understanding into an individual's ability to manage added financial obligation properly. Lenders determine this ratio by dividing the complete month-to-month financial obligation obligations of a candidate by their gross regular monthly earnings. A lower debt-to-income ratio suggests that a consumer has more revenue readily available to cover their financial debt settlements, making them a much more appealing prospect for an equity funding.

Lenders generally have specific debt-to-income ratio requirements that debtors should satisfy to get an equity car loan. While these needs can vary among lending institutions, a typical standard is a debt-to-income ratio of 43% or lower. Consumers with a greater debt-to-income proportion may deal with obstacles in protecting authorization for an equity lending, as it recommends a greater threat of back-pedaling the lending. Home Equity Loans. As a result, it is browse around this web-site crucial for candidates to evaluate and possibly decrease their debt-to-income ratio prior to obtaining an equity funding to raise their opportunities of approval.

Residential Property Assessment Demands

Evaluating the worth of the home with a comprehensive evaluation is a basic action in the equity financing approval procedure. Lenders need a residential property evaluation to make sure that the home offers adequate collateral for the lending amount asked for by the customer. During the home appraisal, a qualified evaluator evaluates numerous elements such as the property's condition, size, location, equivalent residential property values in the location, and any kind of distinct attributes that might affect its general worth.

The property's assessment value plays an essential role in determining the optimum amount of equity that can be obtained against the home. Lenders generally call for that the assessed value satisfies or surpasses a certain percent of the funding quantity, referred to as the loan-to-value ratio. This proportion helps alleviate the lender's danger by ensuring that the residential or commercial property holds adequate value to cover the funding in case of default.

Ultimately, a thorough home assessment is important for both the loan provider and the debtor to accurately assess the building's worth and identify the feasibility of approving an equity finance. - Home Equity Loan

Understanding Loan-to-Value Ratio

The loan-to-value ratio is a crucial monetary metric made use of by lenders to examine the risk connected with offering an equity lending based on the property's assessed worth. This ratio is calculated by dividing the quantity of the lending by the assessed worth of the residential property. For instance, if a residential property is evaluated at $200,000 and the funding amount is $150,000, the loan-to-value proportion would be 75% ($ 150,000/$ 200,000)

Lenders utilize the loan-to-value proportion to identify the degree of risk they are handling by giving a car loan. A greater loan-to-value ratio suggests a higher danger for the lending institution, as the borrower has much less equity in the home. Lenders commonly prefer lower loan-to-value ratios, as they offer a pillow in case the borrower defaults on the loan and the residential property requires to be sold to recoup the funds.

Borrowers can also take advantage of a lower loan-to-value proportion, as it might result in better finance terms, such as lower rate of interest or minimized costs (Alpine Credits Canada). Recognizing the loan-to-value proportion is crucial for both lenders and borrowers in the equity finance authorization procedure

Verdict

In verdict, the certification procedure for an equity car loan authorization is based on key eligibility criteria, credit report rating importance, debt-to-income proportion analysis, home assessment demands, and comprehending loan-to-value ratio. Understanding these aspects can aid individuals browse the equity lending authorization process more properly.

Recognizing the interplay in between debt-to-income ratios, loan-to-value ratios, and other crucial requirements is paramount in protecting authorization for an equity financing.Given the crucial function of credit history scores in figuring out equity financing authorization, an additional vital facet that loan providers analyze is a candidate's debt-to-income proportion evaluation - Alpine Credits Equity Loans. Debtors with a greater debt-to-income ratio may encounter obstacles in protecting approval for an equity financing, as it suggests a higher risk of failing on the lending. It is essential for candidates to assess and potentially reduce their debt-to-income ratio prior to using for an equity finance to boost their possibilities of authorization

In conclusion, the qualification process for an equity financing approval is based on essential qualification standards, credit rating score significance, debt-to-income ratio analysis, property assessment demands, and recognizing loan-to-value ratio.

Report this page